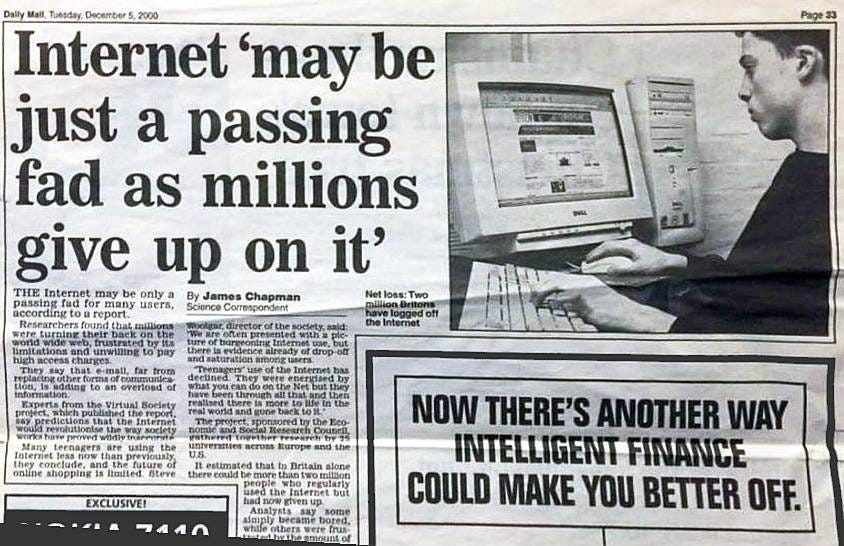

The Internet may be just a passing fad... NFTs, FTX & Crypto

By Josh Bobrowsky

What just happened

Sam Bankman-Fried went from a net worth of $16 billion to bankruptcy in 4 days

Just a few months ago Sam spent billions bailing out insolvent crypto entities, offered to buy Coinbase and wrote to Elon Musk to help fund buying Twitter

FTX went from one of the largest crypto exchanges in the world to insolvency

Alameda Research (The FTX trading shop) has gone from multi-billion dollar hedge fund to insolvent

ETH has gone from $1600 to $1200

FTT (FTX token) has gone from $23 per coin to $3 per coin

Funds on the FTX exchange cannot be withdrawn

Sam may now be on the run

FTX Ventures, the venture arm of FTX, has removed their website

CZ, the owner of Binance, was an early investor in FTX. He began selling his shares of FTT and announced they may buy FTX

After looking at the books of FTX, CZ decided not to buy FTX

It appears FTX may have been using customer deposits to trade with, without customer consent

Cryptocurrency valuations have dropped by over $150 billion, from $1 trillion to $842 billion

I am left in disbelief

My thoughts

Watching this all unfold in real time I am left in disbelief.

So many of my friends have lost more money than they ever imagined might even be at risk. Lots of people are in real pain.

It is hard not to simply feel disappointed at many levels.

At the same time we are 2 days into a massive crisis and this is far from over.

The Internet, Cryptocurrencies & NFTs

I continue to feel solid and positive about the long term prospects of NFTs and cryptocurrency.

As I have said for months, NFTs are the future but we may simply not be moving into the future with the current wave of NFTs.

Most are junk.

This isn’t the first exchange to crash, and this won’t be the last “black swan” event we see in crypto or in finance. Waves and cycles are part of the game in any financial industry.

Every new industry is riddled with challenging times, early scandals and bad actors. From the internet, to electricity to the automobile industries.

All that said, we are likely in for some times of uncertainty. The downward swing of the dot com bubble lasted almost a decade, but it was needed to usher in the next wave of innovation.

Where do we go from here

The next 6 to 24 months are likely to be an incredibly challenging time. I expect to see high variance, quick shifts, frauds exposed and confusion across the board. The pieces have shifted and the dust has not settled.

This will also be the time when new titans of industry will arise, when great new companies and leaders are built and where opportunity will be found once again.

Conclusion

Things are hard, and they will continue to be hard. This is a natural and unfortunate part about where we are today. However, the short term pain has not changed my perspective about the long run future of our industry.

The fall of a single exchange has not changed the underlying technology or potential future use cases of digital ownership.

Be careful out there and be kind to yourself and others during the hard times.

Cheers

Josh Bobrowsky

Sir, you wrote Aleman instead of Alameda. Idk if you can eddit it. Great read.