Nothing here is financial advice, just my opinion and thoughts. Do not rely on this in any financial capacity.

11 Bitcoin ETFs were approved this month. This is just the start.

The ETFs

Below are the approved Bitcoin ETFs:

ARK: NYSE: ARKB

Bitwise: NYSE: BITB

BlackRock: NASDAQ: IBIT

Franklin: NYSE: EZBC

Fidelity: NYSE: FBTC

Grayscale: NYSE: GBTC

Galaxy: NYSE: BTCO

Hashdex: NYSE ARCA: DEFI

WisdomTree: NYSE: BTCW

VanEck: NYSE: HODL

Valkyrie: NASDAQ: BRRR

For those not familiar, an ETF is an electronically traded fund. These ETFs are important because it allows traditional finance to access Bitcoin without needing to go through the challenges of opening an account with a cryptocurrency exchange or having self custody through a hardware wallet.

Why this is important

On many levels this is another step to legitimize Bitcoin & crypto as a “real financial asset”.

Older people can buy Bitcoin in a way that allows for a succession plan that is easy for them to understand. Also allows a layer of safety.

Bitcoin is a gateway drug to other crypto. ETH ETFs are already being discussed and as people look more deeply the technology becomes increasingly interesting.

For those who are in crypto it makes conversations with friends and family easier to understand and less likely to end with them saying “yeah but I hear crypto is a scam.” Bitcoin was under $1,000 at the time of the video below.

Retirement and pension funds can access Bitcoin through traditional trading platforms.

Larger institutions can gain exposure without being deep in crypto technology and security itself.

The full impact will take years

It will take years for the full impact of the 11 ETFs to be seen. My guess is that in 3 years allocating 1-5% of investment portfolios will be considered the norm.

Today a split between stocks and bonds is normal, in the future I think the conversation will be stocks, bonds and crypto.

What makes Bitcoin valuable

In 2020 a single article written by Paul Tudor Jones solidified my belief that Bitcoin was one of the better financial assets. For those not familiar with Jones he runs Tudor Investment Corporation which has over $30 billion under management.

Jones breaks down stores of value by 4 primary categories (full letter here you should read it)

Purchasing Power – How does this asset retain its value over time?

Trustworthiness – How is it perceived through time and universally as a store of value?

Liquidity – How quickly can the asset be monetized into a transactional currency?

Portability – Can you geographically move this asset if you had to for an unforeseen reason?

When viewed through this lens Bitcoin stands out as an incredibly valuable asset that is also a fraction of the value of its competitors. See chart from letter below.

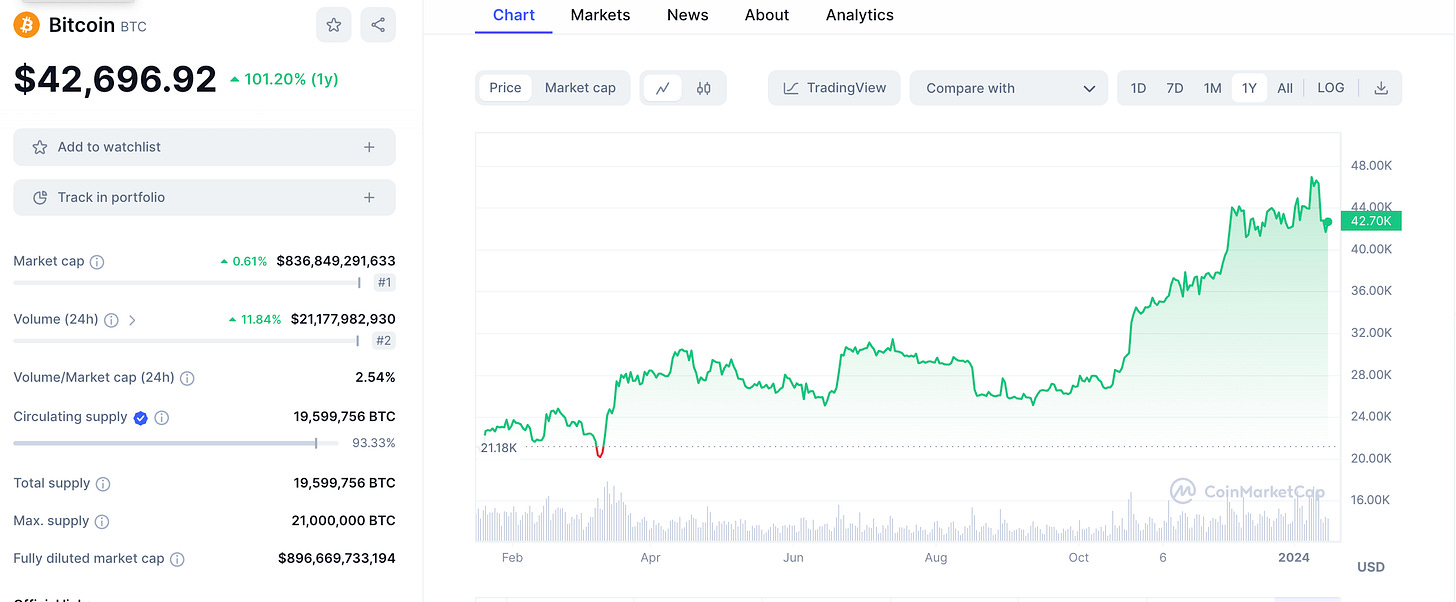

IRR of Bitcoin vs S&P 500 over last 10 years

S&P 500: Roughly 13.5%

Bitcoin: Roughly 140%

To be fair, the IRR of Bitcoin has dramatically slowed down in recent years, and I would not expect 140% IRR to continue. But, the asset is still up over 100% in the last 12 months.

Where do we go from here

Going a step further, it is easy to see that many financial assets will be moving on-chain. My general thoughts are that next wave in this evolution will be digital assets in video games. Gaming NFTs will allow ownership and a more rich connection with the games themselves.

But it doesn’t stop there, listening to Larry Fink CEO of BlackRock, he believes most financial assets will move on-chain (meaning move into crypto).

One thing is clear, the big players are paying attention.

Conclusion

To say I am excited about the ETFs would be an understatement. However, I realize that many of these things will take years to play out in a material way.

This is a massive step for many people in the cryptocurrency industry and also many in traditional finance.

I’m excited for what we saw earlier this month and even more excited for what the future will bring.

Cheers

Josh Bobrowsky