1. Yuga Labs: $450 Milllion: Metaverse & NFT Acquisitions

Lead Investor: Andreessen Horowitz (A16Z)

Round of funding: “Seed” but really just first round

Proposed use of funds: Acquire CryptoPunks (largest competitor), build an online ecosystem

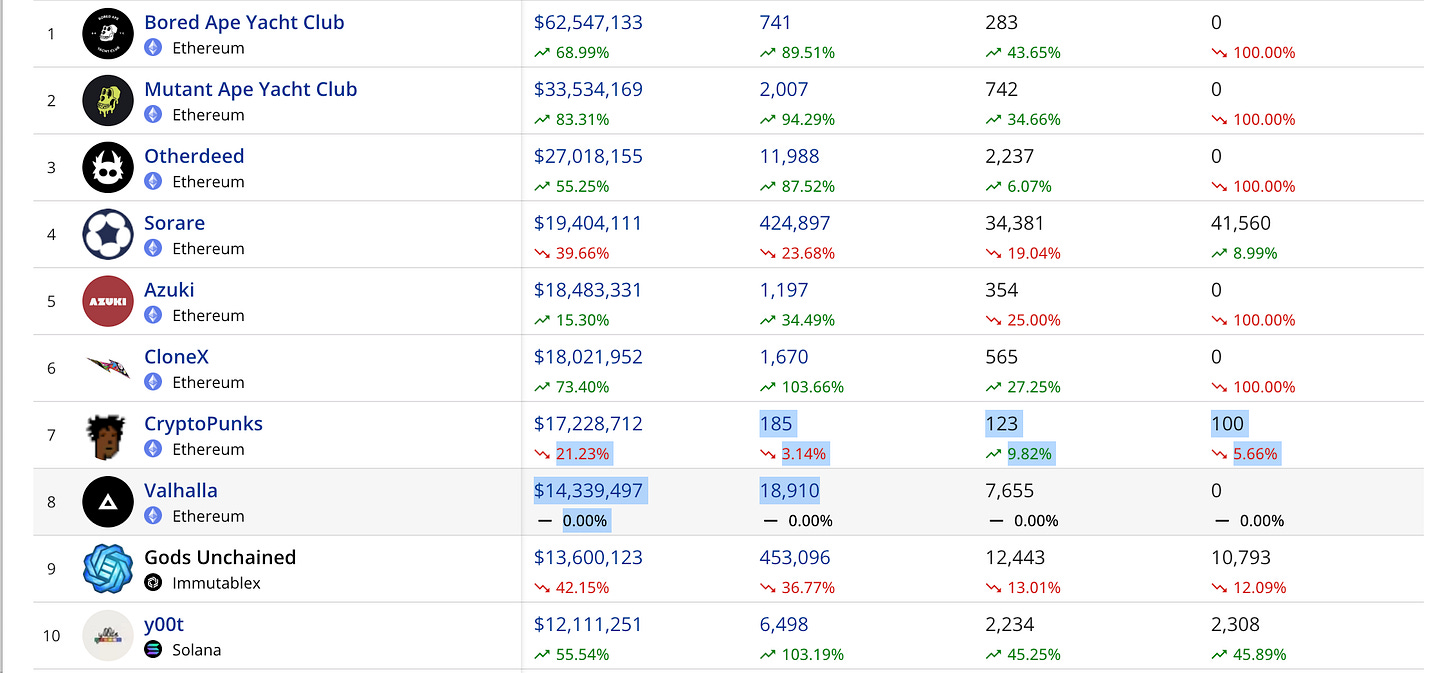

Thoughts: Yuga had a huge funding round as the current market leader in NFTs. The acquisition of Punks was a smart play giving them dominance over the top NFTs in the world. Outwardly, I have not seen much on what they may have built with a metaverse product or timeline. Below are the top 10 NFTs by trading volume for the last 3 days. Yuga owns spot 1, 2, 3 & 7. The investment round into Yuga has 40 investors according to crunchbase.

2. Limit Break: DigiDaigaku $200 Million: Gaming

Lead Investor: Standard Crypto

Round of funding: First round of funding

Proposed use of funds: Build out online gaming platform for NFTs that is appealing to an international audience with a focus on Japenese themed gaming.

Thoughts: LB is run by Gabe Leydon. He was formerly CEO of Machine Zone, one of the largest creators of mobile games and best known for Game of War.

I’m personally a fan of this project but like everything else there has not been enough execution to know if it will be successful yet.

3. Genies: $150 Million: Avatars

Lead Investor: Silver Lake

Round of funding: Series C

Proposed use of funds: Create Metaverse avatars & fashion

Thoughts: Avatars for the metaverse are going to be huge, but not every avatar will be $500k. Many will be in the range of $10-$300 and I’m guessing this is where Genies steps in. They also appear to have significant relationships with celebrities to create avatars for them as well.1

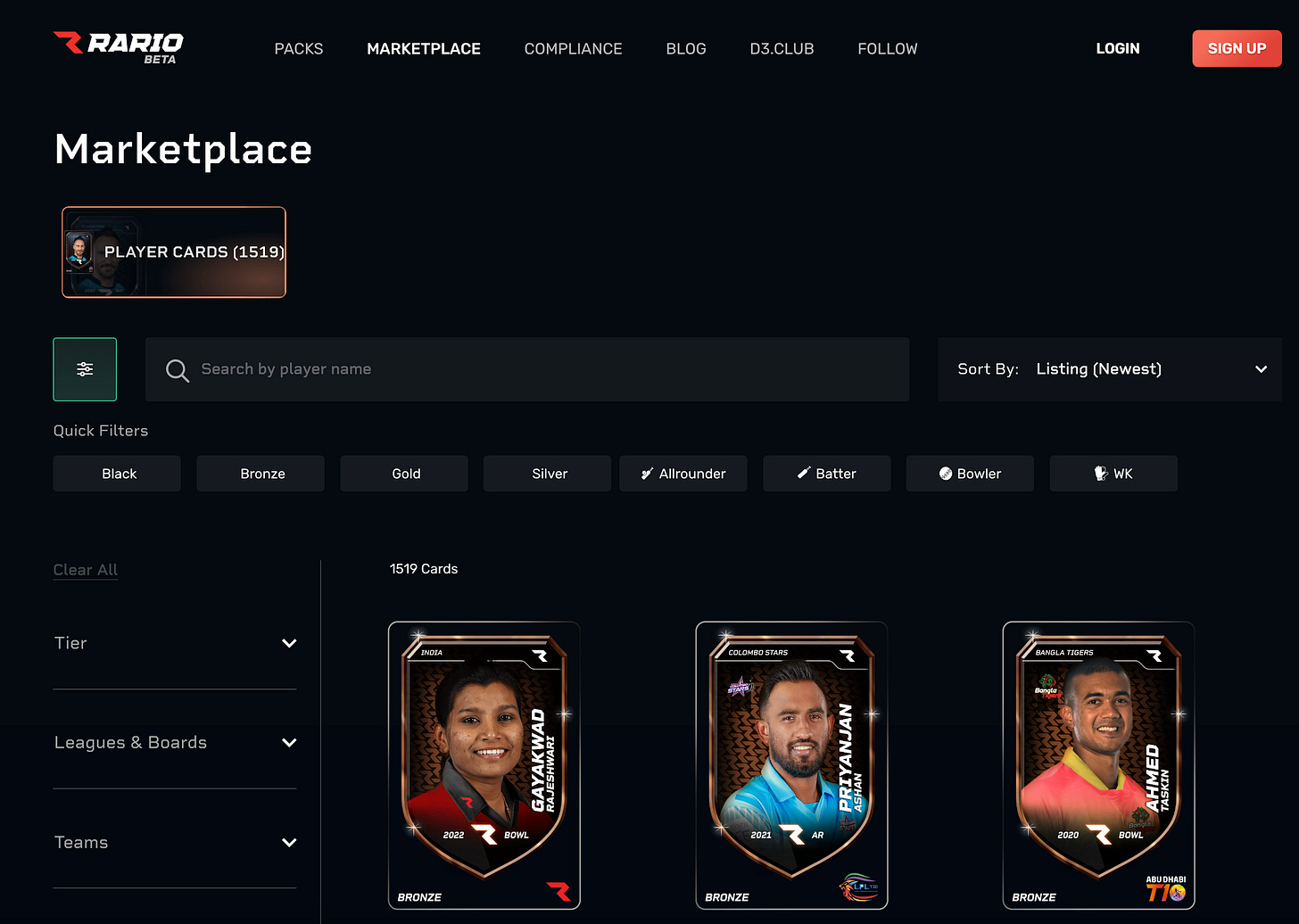

4. Rario: $120 Million: Sports Cricket

Lead Investor: Dream Capital

Round of funding: Series B

Proposed use of funds: Build sports NFT franchise around cricket

Thoughts: Cricket is the second most popular sport and with the investment from Dream Sports Rario now has access to a roster of over 900 cricket players. The company is based out of Singapore and will now have access to 140 million cricket fans. India has the largest fan base for cricket.

5. Homa Games: $100 Million: Gaming

Lead Investor: Quadrille Capital

Round of funding: Series B

Proposed use of funds: Enhance brand, expand mobile gaming to Web 3 gaming

Thoughts: With $164 million in total funding Homa Games has one of the largest war chests of any new NFT creator. Floor price currently sits at under 0.1ETH which feels surprising. The question is how much money and effort do they put into building out a Web 3 NFT brand. To date TikTok appears to be their largest social platform.

Below is a tweet from this week from their CEO describing what they are building:

6. Pixel Vault: $100 Million

Lead Investor: 01 Advisors and Velvet Sea Ventures

Round of funding: Series A

Proposed use of funds: Expand ecosystem

Thoughts: Since funding the supply of NFTs in this project has grew to over 300,000 NFTs. PV has set up partnerships with the National Baseball League, and may be building a video game in the near future. They have also set up their own market place. Some of the funding may have been used to buyout previous investors.

7. Ready Player Me: $56 Million: Avatars

Lead Investor: Andreessen Horowitz (A16Z)

Round of funding: Series A

Proposed use of funds: Build online avatars

Thoughts: One of the coolest things about this company is it lets you upload a picture of yourself and it renders it into an NFT style avatar for use in the metaverse. Current avatar partners include RTFKT so I uploaded a picture of me and it was stylized for the theme of RTFKT check it out below.

Conclusion

2022 has been a year of massive funding for many NFT brands. Over $1 billion in funding in just these companies in 2022. I’m excited to look back at this post in 5 years. We will get to see which of these 7 companies executed at a high level.

Cheers

Josh Bobrowsky

https://venturebeat.com/games/genies-raises-150m-at-over-1b-valuation-for-metaverse-avatars/

NFTs are here to stay!